A

structured settlement is a financial or

insurance arrangement, including periodic payments, that a claimant accepts to resolve a personal injury

tort claim or to compromise a statutory periodic payment obligation. Structured settlements were first utilized in Canada and the United States during the 1970s as an alternative to

lump sum settlements. Structured settlements are now part of the statutory tort law of several

common law countries including Australia, Canada, England and the United States. Although some uniformity exists, each of these countries has its own definitions, rules and standards for structured settlements. Structured settlements may include income tax and spendthrift requirements as well as benefits. Structured settlement payments are sometimes called “periodic payments.” A structured settlement incorporated into a trial judgment is called a “periodic payment judgment."

Structured Settlements in the United States

The United States has enacted structured settlement laws and regulations at both the federal and state levels. Federal structured settlement laws include sections of the (federal) Internal Revenue Code[1]. State structured settlement laws include structured settlement protection statutes and periodic payment of judgment statutes. Medicaid and Medicare laws and regulations affect structured settlements. To preserve a claimant’s Medicare and Medicaid benefits, structured settlement payments may be incorporated into “Medicare Set Aside Arrangements” “Special Needs Trusts."

Structured settlements have been endorsed by many of the nation's largest disability rights organizations, including the American Association of People with Disabilities [2] and the National Organization on Disability [3].

Definitions

The United States definition of “structured settlement” for federal income taxation purposes, found in Internal Revenue Code Section 5891(c)(1) (26 U.S.C. § 5891(c)(1)), is an "arrangement" that meets the following requirements:

- A structured settlement must be established by:

- A suit or agreement for periodic payment of damages excludable from gross income under Internal Revenue Code Section 104(a)(2) (26 U.S.C. § 104(a)(2)); or

- An agreement for the periodic payment of compensation under any workers’ compensation law excludable under Internal Revenue Code Section 104(a)(1) (26 U.S.C. § 104(a)(1)); and

- The periodic payments must be of the character described in subparagraphs (A) and (B) of Internal Revenue Code Section 130(c)(2) (26 U.S.C. § 130(c)(2))) and must be payable by a person who:

- Is a party to the suit or agreement or to a workers' compensation claim; or

- By a person who has assumed the liability for such periodic payments under a qualified assignment in accordance with Internal Revenue Code Section 130 (26 U.S.C. § 130).

Legal Structure

The typical structured settlement arises and is structured as follows: An injured party (the claimant) settles a tort suit with the defendant (or its insurance carrier) pursuant to a settlement agreement that provides that, in exchange for the claimant's securing the dismissal of the lawsuit, the defendant (or, more commonly, its insurer) agrees to make a series of periodic payments over time. The insurer, a property/casualty insurance company, thus finds itself with a long-term payment obligation to the claimant. To fund this obligation, the property/casualty insurer generally takes one of two typical approaches: It either purchases an annuity from a life insurance company (an arrangement called a "buy and hold" case) or it assigns (or, more properly, delegates) its periodic payment obligation to a third party which in turn purchases an annuity (which arrangement is called an "assigned case").

In an unassigned case, the property/casualty insurer retains the periodic payment obligation and funds it by purchasing an annuity from a life insurance company, thereby offsetting its obligation with a matching asset. The payment stream purchased under the annuity matches exactly, in timing and amounts, the periodic payments agreed to in the settlement agreement. The property/casualty company owns the annuity and names the claimant as the payee under the annuity, thereby directing the annuity issuer to send payments directly to the claimant. If any of the periodic payments are life-contingent (i.e., the obligation to make a payment is contingent on someone continuing to be alive), then the claimant (or whoever is determined to be the measuring life) is named as the annuitant or measuring life under the annuity.

In an assigned case, the property/casualty company does not wish to retain the long-term periodic payment obligation on its books. Accordingly, the property/casualty insurer transfers the obligation, through a legal device called a qualified assignment, to a third party. The third party, called an assignment company, will require the property/casualty company to pay it an amount sufficient to enable it to buy an annuity that will fund its newly accepted periodic payment obligation. If the claimant consents to the transfer of the periodic payment obligation (either in the settlement agreement or, failing that, in a special form of qualified assignment known as a qualified assignment and release), the defendant and/or its property/casualty company has no further liability to make the periodic payments. This method of substituting the obligor is desirable for property/casualty companies that do not want to retain the periodic payment obligation on their books. Typically, an assignment company is an affiliate of the life insurance company from which the annuity is purchased.

An assignment is said to be "qualified" if it satisfies the criteria set forth in Internal Revenue Code Section 130 [1]. Qualification of the assignment is important to assignment companies because without it the amount they receive to induce them to accept periodic payment obligations would be considered income for federal income tax purposes. If an assignment qualifies under Section 130, however, the amount received is excluded from the income of the assignment company. This provision of the tax code was enacted to encourage assigned cases; without it, assignment companies would owe federal income taxes but would typically have no source from which to make the payments.

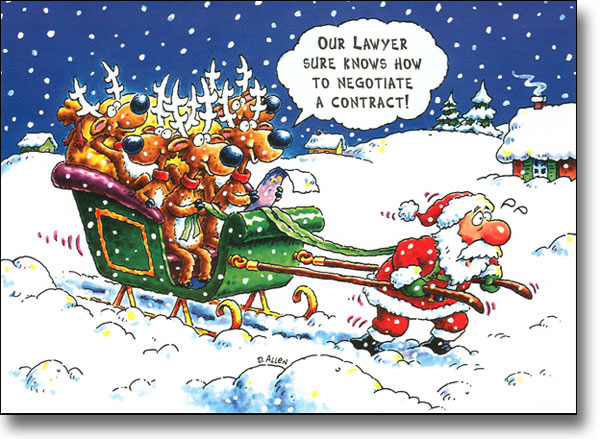

![[christmaspet1.jpg]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgC8X_qfLbLE92vPUtcTsoN2Us4fY_gcmljOPo-qZo8C7a4-WDIleXlEzZ5wFwnN8xhj4PSqoVzuA7EgBmVoYvnMkIYQaNSC94yz0eXtMrLZzMnCduKPKTr5SUbgt1L8GHkOdYsSlhuMbU/s1600/christmaspet1.jpg)

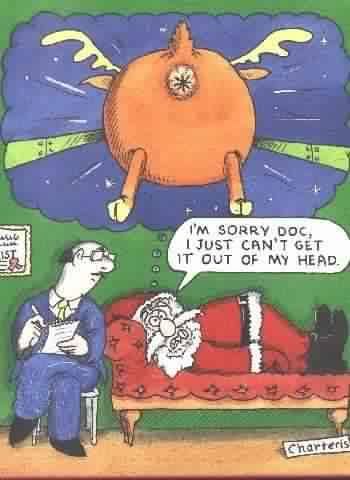

![[christmaspet11.jpg]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhoZSYmj83xXY7S-r7lgtahizVYkW9GO2d70PjGi3IBndI26kMmW4UDgiiLpo55Dh-jLJ3BdKga6KOW9cr1N6CXkK_urre7EirsxpvLGkkKcC0SGmayD5eAC-zCehcSp-MmWM2oYqFooqk/s1600/christmaspet11.jpg)

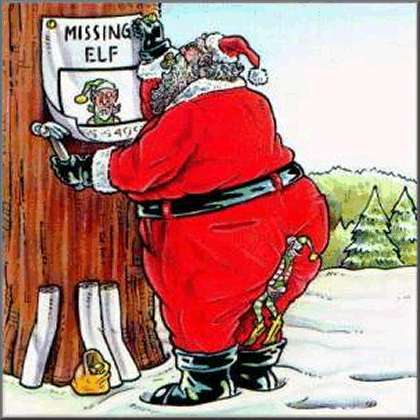

![[badsanta.jpg]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgL66008LQNd0PwSW5EjuCH3-VkGcqeVDeF4ISZJcgBv79gRvxqAjynObpQ5c1e1szNIAn9WsiXCHtDZqL7BzfrehsrO8vaIs6oVwHgbm0i_RuR1n4NEUChkLvPQ01yImaGwEiKBDy_j9Y/s1600/badsanta.jpg)