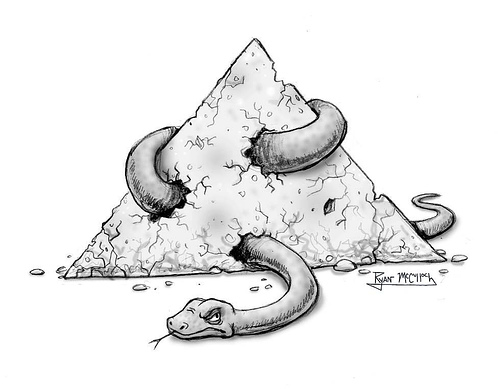

Federal agents have arrested Bernard L. Madoff, a top Wall Street trader and ex-CEO of of Nasdaq for securities fraud. According to the criminal charges, Madoff is alleged to have defrauded investors of $50 billion in what he confessed to authorities was a "massive Ponzi scheme."

The 70-year-old Madoff faces 20 years in prison and a $5 million fine if convicted. He was released on a $10 million bond.

From the NY Times:

Labels: Bernard Madoff, Corporate Fraud, food security

The 70-year-old Madoff faces 20 years in prison and a $5 million fine if convicted. He was released on a $10 million bond.

From the NY Times:

According to the most recent federal filings, Bernard L. Madoff Investment Securities, the firm he founded in 1960, operated more than two dozen funds overseeing $17 billion.

These funds have been widely marketed to wealthy investors, hedge funds and other institutional customers for more than a decade, although an S.E.C. filing in the case said the firm reported having 11 to 23 clients at the beginning of this year.

At the request of the Securities and Exchange Commission, a federal judge appointed a receiver on Thursday evening to secure the Madoff firm’s overseas accounts and warned the firm not to move any assets until he had ruled on whether to freeze the assets.

A hearing on that request is scheduled for Friday.

Regulators said they hoped to have a clearer picture of the losses facing investors by that court hearing.

"We have 16 examiners on site all day and through the night poring over the records", said Mr. Calamari of the S.E.C.

Labels: Bernard Madoff, Corporate Fraud, food security

Source: Dollars And Sense

No comments:

Post a Comment